digital core reit

Digital Core REIT a real estate investment trust engages in the development acquisition ownership and operation of data centres. Day Range 0730 - 0780.

Stake Changes Digital Core Reit Shenton Wire

Digital Core REIT Fundamentals Summary 297x PE Ratio 123x PS Ratio.

. The Company owns and operates global data center. Digital Core REIT has reported a distributable income of US121 million 165 million for the 1QFY2022 ended March 19 higher than the US119 million forecastedDuring the quarter the REIT reported revenue of US265 million 01 lower than forecasted while net property income NPI stood 6. The average capitalisation rate used in the appraised value was 425.

Safe Harbor Statement This press release contains forward-looking statements which are based on current expectations forecasts and assumptions that involve risks and uncertainties that could cause actual outcomes and results to differ materially. The net property income for 2022 is US6686m which represents a property yield of 46. DIGITAL CORE REIT DCRUSI Bloggers Say.

Portfolio operating metrics were also in line with expectations with occupancy rates. In 2022 Digital Core REIT will produce US105 million of revenues and distributable income of US53 million. The average capitalization rate was 425.

285 Mapletree Industrial REIT. Conservative level of gearing. 3 Valuation of Digital Core REIT The IPO portfolio has an average appraised valuation cap rate of 425 valuing the 10 properties at US1440 million.

This was mainly due to some savings in certain trust expenses as well as lower profit attributable to non-controlling interests. Based on the current valuation and Offer price the REIT is offered at 10 times to Net Asset Value NAV basis. The appraised valuation of the assets was US1441b.

Investor Relations Jordan Sadler Jim Huseby Digital Realty. Cents of distributable income per unit. At current shares of US115 per unit its a 37 dividend yield.

Digital Core REIT SGXDCRU Target Price. Digital Core REITs Financial and capital management DC REIT offers an attractive forecast distribution yield of 475 for Year 2022 and 500 for Year 2023 The appraised value of the assets was US1441 million and a 90 stake was purchased by DC Reit without any discount. Also the former has a lower cost of debt of just 11 against its peers 16.

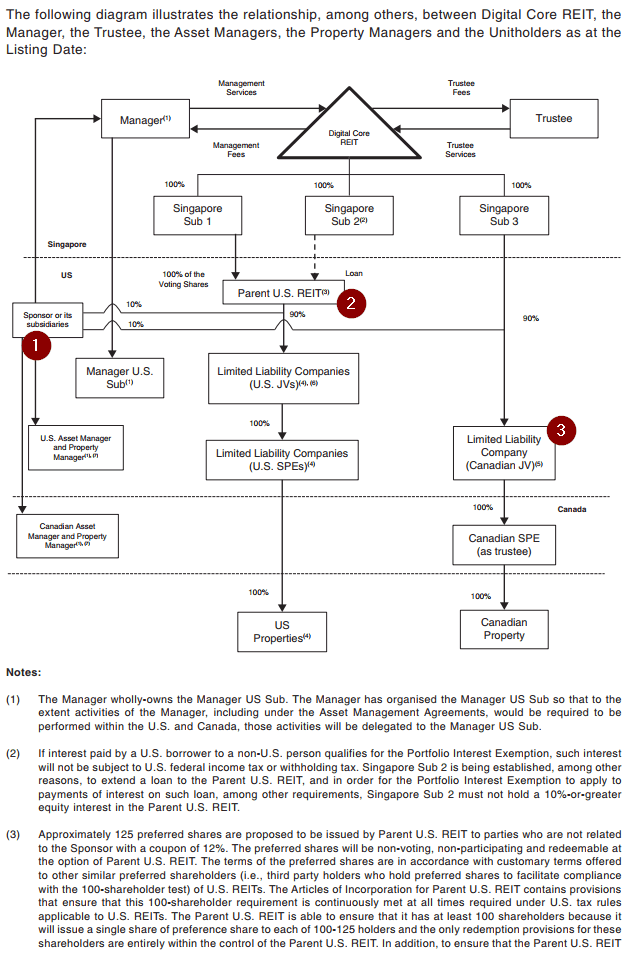

Digital Core REITs debt tenor extends up to five years as compared to 32 years for Keppel DC REIT. Digital Core REIT. Digital Core REIT is a Singapore-based pure-play data center Real Estate Investment Trust REIT.

DIGITAL CORE REIT DCRUSI News. Find the latest Digital Core REIT DCRUSI stock quote history news and other vital information to help you with your stock trading and investing. Change -0020 -260.

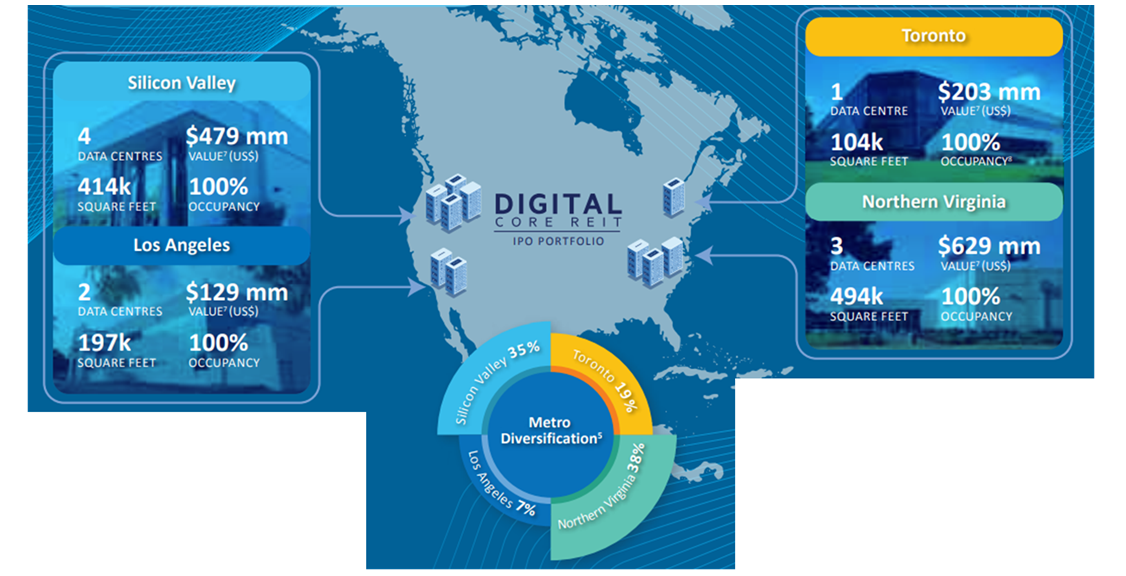

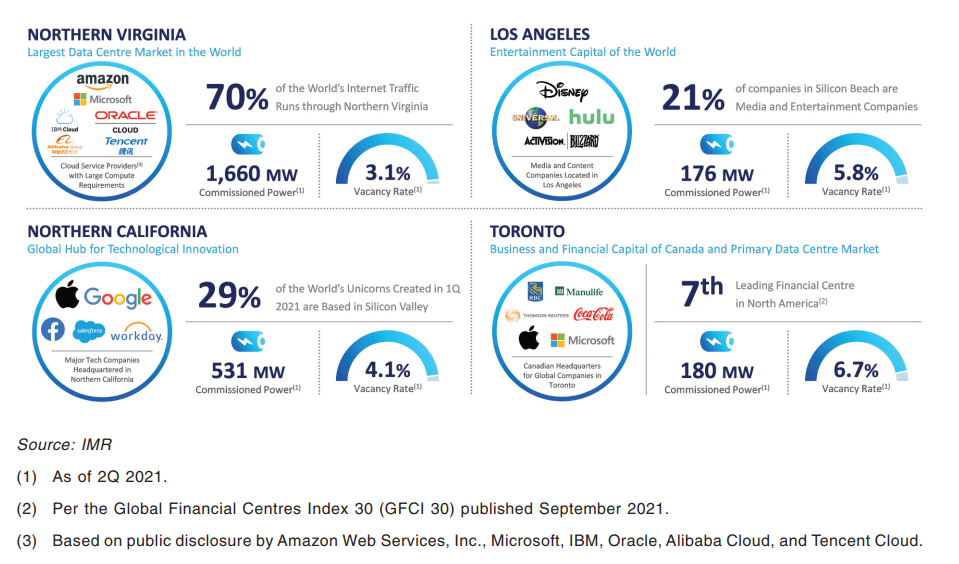

It has 10 mission-critical data centres located in the United States and Canada. Digital Core REIT has long WALE of 55 years. Last Traded Date 2022-07-01.

Here is the net debt-to-asset this will be different from what is published comparison. But whats interesting about data centres is its high tenant retention rate. 1300 prev 1400 UOB Kay Hian.

Occupancy rate for all 10 data centres remains at 100. Digital Core REIT is a Singapore REIT S-REIT established with the principal investment strategy of investing directly or indirectly in a diversified portfolio of stabilised income-producing real estate assets located globally which are used primarily for data centre purposes as well as assets necessary to support the digital economy. Designed built and operated in line with Digital Realty commitment to sustainable solutions High-Quality Customer Base Digital Core REITs top customers in portfolio consist of Fortune Global 500 cloud companies global colocation and interconnection providers social media platforms and IT services companies.

Digital Core REIT has the lower gearing of 27 against Keppel DC REITs 351. Digital Core REIT offers an attractive distribution yield of 475 for Year 2022 and 5 for Year 2023. Digital Core REIT Management Pte Ltd COMPANY INFO 077 USD -006 -667 Add To Watchlist As of 0504 AM EDT 06302022 EDT Subscribe for 199 today.

1100 prev 1320 View the most recent target price. Even if its all-in cost of borrowings rises to 3 Digital Core REIT is expected to generate forward yields of 52 and 57 in FY2022 and FY2023 respectively the analysts write. Digital Core REIT SGXDCRUs 1Q22 earnings were in line with forecasts and Distributable income was slightly ahead of IPO projections by 2.

338 Digital Core REIT. The company was incorporated in 2021 and is based in Singapore. Digital Core REIT aims to create long-term sustainable value for all stakeholders through ownership of a stabilized and diversified portfolio of mission-critical data center facilities concentrated in select global metros.

475 FY2022 and 526 FY2023 We cannot just look at the dividend yield alone but the relative leverage of the three REITs. Based on their estimates following a sensitivity analysis Digital Core REITs share price at 77 US cents 107 provides an opportunity to seek yields. The Companyâs customers in portfolio consist of Fortune Global 500 cloud companies global colocation and interconnection providers social media platforms and information technology IT.

DIGITAL CORE REIT DCRUSI Bloggers Say. Digital Core Reit is established with the principal investment strategy of investing directly or indirectly in a diversified portfolio of stabilised income-producing real estate assets located globally which are primarily used for data centre purposes as well as assets necessary to support the digital economy. Digital Core REIT SGXDCRU Stock Info.

Last Traded Share Price 0750. Digital Core REIT SGXDCRU reported distributable income of US121m which is 19 above forecast and in line with our expectations. On all three strikes the new data centre REIT comes out ahead as the winner.

4 The Sponsor Is Digital Realty One Of The Largest REITs In the US.

Digital Core Reit Pure Play Data Centre S Reit Debuts On Sgx Sgx My Gateway

Cromwell European Digital Core Reits Surge On High Volume Of Married Deals Reitsweek

5 Reasons Why I Would Apply For Digital Core Reit Ipo

Digital Core Reit Portfolio Portfolio Overview

Digital Core Reit Ipo Review Why I Am Subscribing For This 4 75 Yield Reit Ipo Of The Year Financial Horse

Digital Core Reit Stock Info Sgx Dcru Sg Investors Io

4 75 Yielding Digital Core Reit Is A Premium Reit Ipo My Thoughts Investment Moats

Better Buy Keppel Dc Reit Vs Digital Core Reit The Smart Investor

Digital Core Reit Ipo New Pure Play Data Centre In Sg With 4 75 Yield

Brokers Take Dbs Starts Digital Core Reit At Buy With Us 1 40 Target Companies Markets The Business Times

4 75 Yielding Digital Core Reit Is A Premium Reit Ipo My Thoughts Investment Moats

Digital Realty Ties Refinancing To Sustainability Targets Files Prospectus For Singapore Reit Ipo Dcd

Digital Core Reit Is Offering A 4 75 Distribution Yield Is This Sustainable The Smart Investor

Dbs Digital Core Reit Buy Tp Us 1 40 Alpha Edge Investing

Brokers Take Uobkh Downgrades Digital Core Reit To Hold On Rising Cost Of Debt Companies Markets The Business Times

Digital Realty Launches 977m Core Data Center Reit Via Singapore Ipo Dgtl Infra

Digital Core Reit Ipo 2021 Could It Overtake Keppel Dc Reit

0 Response to "digital core reit"

Post a Comment